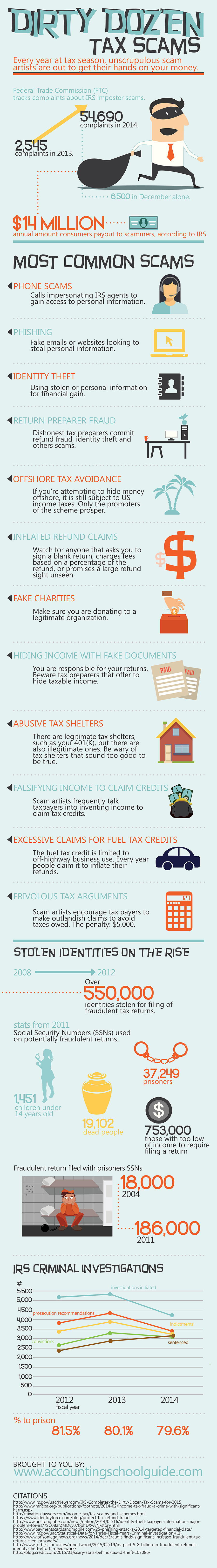

Dirty Dozen Tax Scams

Every year at tax season, unscrupulous scam artists are out to get their hands on your money.

In 2013, the FTC received 2,545 complaints about IRS impostor scams.

In 2014: 54,690

6500 in December alone.

$14 million: Amount IRS says consumers pay out annually to scammers.

The Dirty Dozen:

An IRS list of the most common scams :

• Phone Scams: Calls impersonating IRS agents to gain access to personal information.

• Phishing: Fake emails or websites looking to steal personal information.

• Identity Theft: Using stolen personal information for financial gain.

• Return Preparer Fraud: Dishonest tax preparers commit refund fraud, identity theft and other scams.

• Offshore Tax Avoidance: If you’re attempting to hide money offshore, it is still subject to US income taxes. Only the promoters of the scheme prosper.

• Inflated Refund Claims: Watch for anyone that asks you to sign a black return, charges fees based on a percentage of the refund, or promises a large refund sight unseen.

• Fake Charities: Are you donating to a legit organization?

• Hiding Income with Fake Documents: You are responsible for your returns. Beware tax preparers that offer to hide taxable income.

• Abusive Tax Shelters: There are legitimate tax shelters, such as your 401(k), but there are also illegitimate ones. Be wary of tax shelters that sound too good to be true.

• Falsifying Income to Claim Credits: Scam artists frequently talk taxpayers into inventing income to claim tax credits.

• Excessive Claims for Fuel Tax Credits: The fuel tax credit is limited to off-highway business use. Every year people claim it to inflate their refunds.

• Frivolous Tax Arguments: Scam artists encourage taxpayers to make outlandish claims to avoid taxes owed. The penalty: $5,000.

Stolen Identities on the Rise

2008-2012: 550,000 taxpayers’ identities stolen for the filing of fraudulent tax returns.

In 2011, potentially fraudulent returns were filed using the SSNs of:

1,451 children under 14 years old;

19,102 dead people;

37,249 prisoners;

753,000 people whose income level did not require a tax return.

Increase in fraudulent tax returns filed with a SSNs of prisoners:

18,000 in 2004

186,000 in 2011.

In 2014: 28.8% of phishing attacks used to steal financial data from users.

16.3% of phishing attacks used names of well-known banks.

Sources:

http://www.irs.gov/uac/Newsroom/IRS-Completes-the-Dirty-Dozen-Tax-Scams-for-2015

https://www.mncpa.org/

http://taxation.lawyers.com/income-tax/tax-scams-and-schemes.html

https://www.identityforce.com/blog/protect-tax-refund-fraud

http://www.bostonglobe.com/news/nation/2014/02/16/identity-theft-taxpayer-information-major-problem-for-irs/7SC0BarZMDvy07bbhDXwvN/story.html

http://www.paymentscardsandmobile.com/25-phishing-attacks-2014-targeted-financial-data/

https://www.irs.gov/

https://www.prisonlegalnews.org/news/2014/dec/3/audit-finds-significant-increase-fraudulent-tax-returns-filed-prisoners/

http://www.forbes.com/sites/robertwood/2015/02/19/irs-paid-5-8-billion-in-fraudulent-refunds-identity-theft-efforts-need-work/

http://blog.credit.com/2015/01/scary-stats-behind-tax-id-theft-107086/