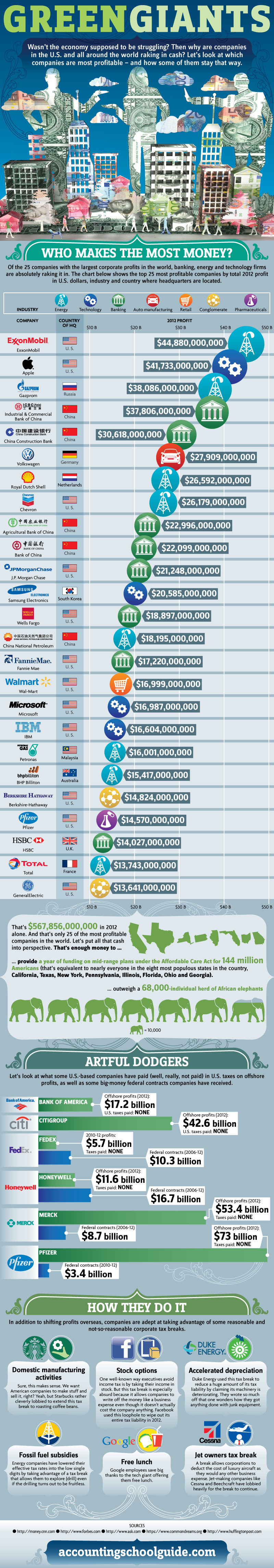

Wasn’t the economy supposed to be struggling? Then why are companies in the U.S. and all around the world raking in cash? Let’s look at which companies are most profitable — and how some of them stay that way.

Who Makes the Most Money?

Of the 25 companies with the largest corporate profits in the world, banking, energy and technology firms are absolutely ranking it in.

Collectively, they made $567,856,000,000 in 2012 alone. And that’s only 25 of the most profitable companies in the world. Let’s put all that cash into perspective. That enough money to …

… provide a year of funding on mid-range plans under the Affordable Care Act for 144 million Americans (that’s equivalent to nearly everyone in the eight most populous states in the country, California, Texas, New York, Pennsylvania, Illinois, Florida, Ohio and Georgia).

… outweigh a 68,000-individual herd of African elephants

Artful Dodgers

Let’s look at what some U.S.-based companies have paid (well, really, not paid) in U.S. taxes on offshore profits, as well as some big-money federal contracts companies have received

Bank of America

Offshore profits (2012): $17.2 billion

U.S. taxes paid: None

Citigroup

Offshore profits (2012): $42.6 billion

U.S. taxes paid: None

FedEx

2010-12 profits: $5.7 billion

Taxes paid: None

Federal contracts (2006-12) $10.3 billion

Honeywell

Offshore profits (2012): $11.6 billion

Taxes paid: None

Federal contracts (2006-12): $16.7 billion

Merck

Offshore profits (2012): $53.4 billion

Taxes paid: None

Federal contracts (2006-12): $8.7 billion

Pfizer

Offshore profits (2012): $73 billion

Taxes paid: None

Federal contracts (2010-12): $3.4 billion

How They Do It

In addition to shifting profits overseas, companies are adept at taking advantage of some reasonable and not-so-reasonable corporate tax breaks.

Domestic manufacturing activities

Sure, this makes sense. We want American companies to make stuff and sell it, right? Yeah, but Starbucks rather cleverly lobbied to extend this tax break to roasting coffee beans.

Stock options

One well-known way executives avoid income tax is by taking their income in stock. But this tax break is especially absurd because it allows companies to write off the money like a business expense even though it doesn’t actually cost the company anything. Facebook used this loophole to wipe out its entire tax liability in 2012.

Accelerated depreciation

Duke Energy used this tax break to reduce a huge amount of its tax liability by claiming its machinery is deteriorating. They wrote so much off that one wonders how they got anything done with junk equipment.

Fossil fuel subsidies

Energy companies have lowered their effective tax rates into the low single digits by taking advantage of a tax break that allows them to explore (drill) even if the drilling turns out to be fruitless.

Free lunch

Google employees save big thanks to the tech giant offering them free lunch.

Jet owners tax break

A break allows corporations to deduct the cost of luxury aircraft as they would any other business expense. Jet-making companies like Cessna and Beechcraft have lobbied heavily for the break to continue.

Sources:

http://money.cnn.com

http://www.forbes.com

http://www.ask.com

https://www.commondreams.org

http://www.huffingtonpost.com